Sep 21, 2010

New Grants and Funding Available!

The PA Department of Environmental Protection expects to reopen their Small Business Advantage Grant, possibly as soon as October 4, 2010. Funds will be available for energy efficiency and pollution prevention projects.

When the program reopens, applications will be accepted and funds will be allocated on a first-come, first-served basis until the funds are exhausted.

Under the program, businesses can apply for a 50 percent matching grant of up to $7,500 for taking actions that save at least 25 percent annually in energy or pollution-related costs. To be eligible, an applicant must be a for-profit company with 100 or few employees.

For help with the application process so you are prepared when the program opens (there are some new requirements), contact your local EMAP consultant or call our toll-free hotline, 1.877.ask.EMAP.

Link to Application Homepage

_____________________________________________________________________________________

USDA Funds for Energy Projects

USDA is currently accepting applications from agricultural producers and rural small businesses for the next round of REAP (Rural Energy for America) grant funding for small projects. These funds can be used for energy efficiency and renewable energy projects.

>>Go to the USDA/REAP website

For help with the application process contact your local EMAP consultant or call our toll-free hotline, 1.877.ask.EMAP.

Sep 13, 2010

If your business is green, get the recognition it deserves

SB decals will soon be available to be prominently displayed in the windows of businesses in at least 22 southwestern PA municipalities, demonstrating evidence of sustainable business practice. In order to qualify for the SB designation, business owners must satisfy at least 15 requirements from 10 different categories which come from an online survey. This survey can be found at www.downtownfirst.net. First click “sustainable certification” in the left-hand column and then on the link directly under “Does your business qualify for the sustainable business designation?” Once qualified for the rating, information on businesses will be available in stores as well as online.

Additional information can be received by calling the Allegheny County Department of Economic Development (412-350-3300).

Jun 8, 2010

Pittsburgh Business Titans Turn Teachers for Special One-Day Entrepreneurship Extravaganza

Ed Stack, CEO of Dick’s Sporting Goods, Inc., and Roger Byford, CEO of Vocollect, will headline the event as keynote speakers.

One of the event’s 15 workshop features a trip of headline-making entrepreneurs who will share how they’re grown their businesses and some of their biggest mistakes. J.C. Carter, President of Wrecking Crew Media, Scott Kerschbaumer, Vice President of ESSpa and Galadriel Strauser, Owner of Simply Clean are teaming up to lead Inspirational Success Stories from Entrepreneurs on the Rise.

The 14 other featured workshops are designed to help attendees (from start-up through growth stages) lower business taxes and increase sales, turn their new product ideas into a business, raise capital, turn their website into their #1 seller, leverage search engines and social networks to find customers, protect business investments, building wealth, use advertising, networking and digital PR for growth and much more.

“Our attendees have come to expect keynote speakers of the highest caliber and this year will be no exception. They are true pioneers in their respective industries,” says Dr. Mary T. McKinney, director of Duquesne’s Small Business Development Center and lead organizer of the event.

One of the event’s most popular features is the Business Building Tradeshow & Networking Mixer that provides the opportunity for attendees to meet representatives from more than 40 of the region’s entrepreneurial support organizations, see hands-on demonstrations and helpful products and services, and visit the Capital Corner, a section dedicated to helping entrepreneurs find funding.

For a complete list of speakers, workshops and registration information, visit www.egc.duq.edu or call 412.396.6233

May 14, 2010

Tax Benefits to Small Businesses through the HIRE Act

New tax benefits are available to employers who hire workers who were previously unemployed or only working part time. They are part of the Hiring Incentives to Restore Employment (HIRE) Act.

Employers who hire unemployed workers this year may qualify for a 6.2 percent payroll tax incentive, essentially exempting them from their share of Social Security taxes on wages paid to these workers after March 18, 2010. This reduced withholding will have no effect on the employee’s future Social Security benefits, and employers will still need to withhold the employee’s 6.2 percent share of Social Security taxes, as well as any income taxes. The employer and employee’s shares of Medicare taxes will also still apply to these wages.

Also, for each worker that is retained for at least a year, businesses may claim an additional general business tax credit, up to $1,000 per worker, when they file their 2011 income tax returns.

The benefits are especially helpful to employers who are adding employees to their payrolls. New hires that fill existing positions will also qualify but only if the workers they replace left voluntarily or for cause. Family members and other relatives do not qualify.

The new law requires that the employer get a statement from each new hire that certifies that he or she was unemployed during the 60 days before beginning work, or that they worked less than a total of 40 hours per week for someone else during the 60-day period.

All forms of businesses, tax exempt organizations, and higher education institutions qualify to claim the payroll tax benefit for eligible newly-hired workers. However, homebased employers cannot claim this benefit.

Employers can claim the payroll benefit on their quarterly filed federal employment tax return. Eligible employers will be able to claim the new incentive on their revised employment tax form for the second quarter of 2010. Further details will be posted on the IRS website.

http://www.irs.gov/businesses/small/article/0,,id=220745,00.html

Small Business Health Care Tax Credit

The credit is available to employers that pay at least half the cost of single coverage for their employees. The maximum credit is 35 percent of premiums paid in 2010 by eligible small business employers and 25 percent of premiums paid by eligible employers that are tax-exempt organizations. Then in 2014 the maximum credit increases to 50 percent of premiums paid by eligible employers and 35 percent of premiums paid by eligible employers that are tax exempt.

The credit is specifically targeted to help small businesses and tax-exempt organizations that primarily employ low and moderate income workers. It is mostly available to employers that have fewer than 25 full time employees paying wages averaging less than $50,000 per employee per year. The maximum credit will go to smaller employers with 10 or fewer full time employees paying annual wages of $25,000 or less.

Eligible businesses can claim the tax credit as part of the general business credit starting with the 2010 income tax return they file in 2011. The IRS plans to provide future information related to tax-exempt employers on how to claim the credit.

http://www.irs.gov/newsroom/article/0,,id=220809,00.html?portlet=6

Apr 14, 2010

Helpful Words from Denis Piper & Associates: Save Time and Reduce Mistakes by Synchronizing Your Data

Here's an easy way to save time and keystrokes: If you use Microsoft Outlook 2002, 2003, or 2007 for contact management and QuickBooks Pro, Premier, or Enterprise 2005 and up for financial management, you can synchronize data to avoid entering the same contact information twice.

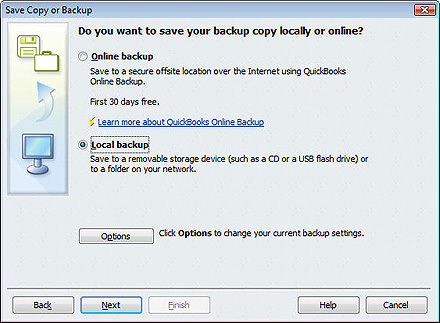

It's easy, but you need to take care to follow instructions precisely anytime you're integrating multiple databases. You can't unring that bell. Start by backing up your data in each program, as shown in Figure 1. For Outlook, check your help files; the data file format changed in 2003. QuickBooks users should use the program's standard built-in tools by clicking File|Save Copy or Backup. You can either save your QuickBooks file locally (to a CD or USB flash drive) or use QuickBooks Online Backup (30-day free trial; starts at $4.95/month for 5 GB).

Figure 1: It's very important that you back up your Outlook and QuickBooks files before you synchronize.

Get in Sync

QuickBooks lets you synchronize three kinds of contact information with Outlook:

1. Customer contact information contained in your Customer & Jobs list

2. Vendor contact information from your Vendor list

3. Contact information on your Other Names list

Note: You can't synchronize employee contact information.

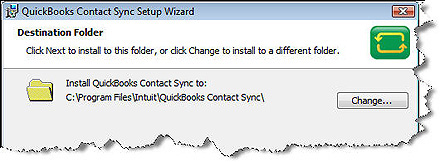

To get started, click File|Utilities|Synchronize Contacts. QuickBooks Contact Sync must be installed on your PC before you do your first sync. When the window shown in Figure 2 opens, click OK and follow the instructions for downloading and installing.

Figure 2: QuickBooks provides a wizard that walks you through the process of downloading and installing QuickBooks Contact Sync.

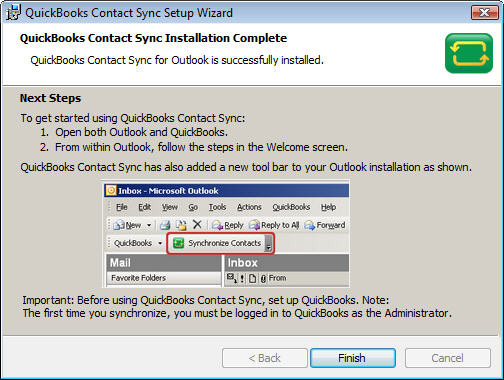

QuickBooks will prompt you to shut down Outlook before you start, if you haven't already done so. When the installation is finished, you'll see the window shown in Figure 3. And you'll notice that the installation has added a new toolbar to your copy of Outlook.

Figure 3: QuickBooks tells you when your QuickBooks Contact Sync has installed properly.

Click Finish and restart Outlook. You'll see a window titled QuickBooks Contact Sync for Outlook (this can be disabled once you've gone through the initial import by unchecking the box in the lower left corner). Make sure you're logged into QuickBooks as the Administrator and that the company file you want to synchronize is open.

Click Get Started. A box that says Connecting to QuickBooks will open, and there'll be a short delay. After the connection is made, the Begin Setup window opens. Click the Setup button to launch the wizard. If you have more than one Outlook contact file (for example, if you use Outlook with Business Contact Manager), you'll have to select the file you want to sync.

Click Next. The next screen asks you to specify which contact types you want to sync (customers, customer jobs, and/or vendors). If any of your contacts are personal, you can choose to exclude those. Click Next after each of those screens.

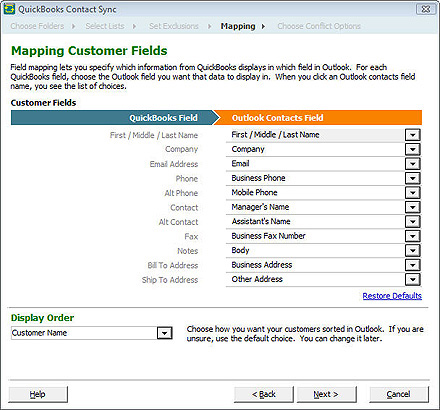

QuickBooks Contact Sync includes a mapping tool, which helps ensure that the correct fields in each program are matched. For example, Company in one program should "map" to Company in the other as shown in Figure 4.

Figure 4: QuickBooks Contact Sync helps you make sure that fields in each program "map" accurately to each other.

The final step in the setup process is critical if you don't want to lose important data, so choose the next option carefully. You need to tell QuickBooks Contact Sync what to do if the same contact exists in both programs but their properties are not exactly the same. Your options:

· Let the Outlook data win

· Let the QuickBooks data win

· Decide in each individual case

Once you've made your selection, click Save. If you want to go back over any of these settings, click Setup. Otherwise, click Cancel or Sync Now.

After you've completed the first synchronization, you'll need to perform a manual sync each time you want to make the databases match. To do so, click the QuickBooks ContactSync menu in Outlook. This menu provides a number of options, including Preferences.

Sync Now and Save Time Later

Feb 26, 2010

Get Answers to the Three Biggest Questions from Peak Performance

What element is essential for obtaining a client?

What element is essential for retaining a client?

What element, when ignored, will facilitate losing a client?

The answer to all three questions is "Trust."

So, what is "trust" and how do you develop it with prospects and preserve it when they become clients?

Trust is built on three elements: credibility, accessibility, and reliability.

Credibility, whether we are talking about prospects or clients, refers to having a message that’s relevant and demonstrates your understanding of the recipient’s situation. Today’s technology—web sites, blogs, e-mail, white papers, social media, webcasts, webinars, and on-line meetings—has made it easier than ever to get your message in front of a targeted audience. Wasting their time with information that doesn’t help them solve problems or further goals will do little to build trust and can erode the trust that has been established.

Getting your credible message in front of prospects and clients is a wasted effort if you are not accessible to provide information for prospects when requested, or answer questions or resolve problems for clients as they occur. If they can’t "trust" that you’ll be there when they need you, then they won’t trust you.

Reliability, the third element of trust, is an essential ingredient for any relationship. If you make a commitment to a prospect or client…keep it. No excuses. Prospects and clients won’t trust you until they can rely on you to follow up and follow through as promised.

Whether we are talking about prospects and clients or friends, family, and colleagues, trust is an essential ingredient. When present, it can cement a relationship and, when absent, cause it to crumble.